|

I just thought that now would be a good time to chat about what keeps us at night. I am confident that many of us have had these worries. If you haven’t, it’s time to start thinking about the future. There are many possibilities of potential circumstances that come with loss and legacy planning. Some include: Loss of Income...As we get older, the size of the "pile of our money" is less important when compared to the income it will produce and the length of time it will continue. Sometimes with age we regress. Early on, we wanted to know what the monthly payment for that car, house, etc. was. Now we want to know the monthly income we can derive from our nest egg. Loss Of Life...Yep, really important. In the case of a married couple, the smaller social security check will go away at the death of a spouse. That will probably cause a problem. Maybe a life insurance policy will help ease the pain. Or what about additional life coverage to pay for the final expenses? We can ease the financial burden if we play the cards right. Loss In The Portfolio...Sure, when we were all young, a market downturn could be viewed as an opportunity. But what about if you are nearing or in retirement? I don't think so. The stakes are much higher, and a significant loss could severely impact your standard of living. Loss Of IndependenceThe inability to do the activities of daily living is a big one. An assisted living community is expensive. Could it be time to present a long-term care solution? Maybe a life policy or annuity that has accelerated or enhanced benefits if you are not able to perform 2 of the 6 activities of daily living? That may help... Legacy PlanningSure, we want to pass on what we have learned, and maybe a little bit of what we have earned. Remember, life insurance goes directly to the named beneficiary, bypasses probate and is free of federal income tax. Maybe it’s time to rollover unneeded assets for income and enhanced benefits.

Are you all aware of the big "L" issues? It’s time to start thinking ahead about the potential circumstances that come with loss and legacy planning. We are here to help! Wow! Did we read that correctly? $107,146... that is the median annual cost in 2024 to receive services in a semi-private room.

So as long as everyone has a couple hundred thousand dollars hanging around, they should be okay. But what if there is a spouse at home? Will they have enough cash to stay in the world that they have become accustomed to? Or even if they decide to stick to a tighter budget, what can they truly afford? Read on... It's not just about having enough to cover the immediate costs. There are ongoing expenses to consider, and if one partner needs care, the other still needs to manage daily living expenses. This situation can quickly drain savings and retirement funds. When savings run out, individuals can become impoverished, relying on Medicaid to cover long-term care costs. However, Medicaid only steps in after you've spent down most of your assets, which can significantly impact your financial stability. So, what options do you have? Financial insurance products can offer a solution by providing funds to cover long-term care expenses. For example, asset-based products and life and annuity products with accelerated death benefits that can help cover long-term care healthcare costs. Planning for long-term care is crucial to ensuring financial stability and protecting your assets. By exploring these insurance products, you can receive peace of mind and security for you and your loved ones, resulting in a better quality of life. To learn more, or get recommendations for an advisor in your area, click here! Isn’t it amazing how we look at the 10-day weather forecasts and plan so much around it? I'm unsure of the scientific proof as to the accuracy of these predictions, but I do know that we pay attention to those predictions. Whether it be heat waves, blizzards, or storm warnings, many life events can be altered to plan around said weather.

Take many hurricanes for example. They can really pack a punch, and most have no idea of the potential severity when looking at the forecasts. It is only after the storm passes that we see the true damage. Not only is this true with weather and storms, but also with our lives. Unexpected challenges can catch us off guard, just like severe weather. We want to remind you that, unfortunately, financial storms are inevitable, and their true effects won't be clear until they've passed. Or perhaps you have been caught in the rain already and you are seeing the effects now. Together we can figure out the best way to weather the storm and better your financial health. So, have you considered discussing your “10-day forecast” with a financial services professional? If not, perhaps it’s time. Imagine a product that lets you share in the upside, never incur a loss, and provides a guaranteed income for the rest of your life, regardless of any 10-day forecast. Preparing for financial stability is crucial, just as we prepare for severe weather. Let’s get a plan in place. Schedule a call with a financial professional in your area. Don’t get caught unprepared in the storms that lie ahead! A little preparation now can make a world of difference when the unexpected happens. “17.3 percent of nonmarried elderly women (widowed, divorced, or never married) are living in poverty today.” – Social Security Office of Policy

This stat really threw me back into my seat. I thought of some of my friends, whose wives were still living, knowing that their wives would not be in good shape if their husbands pass prior to them. There are many reasons for that, but the bottom line is there wouldn't be enough money to keep the wife comfortable in the world that she has become accustomed to. My friends will continue to work at something until they drop. But chances are the husband will go first and for the first time, the wife will get a hard look at the financial picture. And it will come at a hard time, with the passing. There are funeral costs, adjustments to lifestyles, any debts to pay, and many more thing she now must consider extra in her financial spending. Oh, and what about the children? That is a whole other additive to the equation. So, how can we prepare for this tragedy? There is only one cure in most cases - the husband needs more life insurance. Yep, that is the biggest thing that he can do for his wife and family. He doesn't have enough money, can't risk it, and there really is not enough time. It’s a tough reality check, but one we can’t ignore. None of us want to leave our partners struggling after we're gone, yet many folks don’t realize the financial strain until it hits them. We’ve got to face up to the fact that we won’t be around forever, and that means taking action now. Life insurance isn’t just some boring investment—it’s a safety net for the people we care about most. Give the survivors something to remember you by, because after the initial mourning and friends have left, reality will set in. Let’s ditch the excuses and get real about protecting our loved ones’ futures. It might not be the most fun conversation, but it’s one that could make all the difference when it counts. I don’t know about you, but usually if I bring an umbrella with me, it doesn’t rain. But if I leave it in the car, I get soaked. I guess that is why I always have one in my bag. It gives me that sense of security and safety. I know that the weather, like the financial markets, can change at any time without warning. So, I believe in the old saying… “better safe than sorry.” Through annuities and life insurance, we can make sure that whatever may appear in the financial markets, we are safe and secure. An income that we can’t outlive, protection of principal and previous gains, and a very good chance at outpacing other “Safe Money Products.” Annuities Simplified: Guaranteed Returns and Retirement IncomeOne example is the fixed annuity; A product that has been around for ages and yet, still misunderstood by many. That is where Safe Money Places comes into play. Let’s not overcomplicate something that is already complicated enough. Think of a fixed annuity as like buying a subscription for your future. You transfer money into an annuity now, get guaranteed returns during the deferral period, you can receive lifetime retirement payments regularly, either for a specific period or for the rest of your life. Annuities are often used for retirement planning to ensure a steady stream of retirement income when you stop working. Life Insurance Explained: Create a Legacy While Protecting Loved OnesNow let’s take a minute and speak of the big umbrella… life insurance. With a piece of paper and a drop of ink, we can create an instant estate that has benefits paid to the beneficiary tax-free with solid growth of cash value. The product allows one to recover lost legacies with the death benefit. And, with most policies today, these can be purchased without an exam. Products like these can be life changing, not only for you, but for your loved ones. Retirement Planning Assistance: Take Advantage of our Resources and TipsSafe Money Places is here to help you navigate decisions with our free resources. Whether you're puzzling over complex topics or need guidance on choosing the right product, we've got you covered. Dive into our white papers for expert insights, and if you need personalized assistance, our network of agents is just a connection away. Our Safe Money Places Agent Network is nationwide, so we have ample connections to find an agent in your area. Let us make your decision-making process easier.

Recently, I had a meeting with my long-time advisor to review my investment and retirement plans. Over the years, I've relied on their expertise, especially since I transitioned away from managing investments myself. I'd like to share some insights from our discussion. So, as I often say… I am NOT giving investment advice. I am just passing on some thoughts I have as a result of my meeting.

Many of us have enjoyed the performance of our investments, particularly in equities. However, history tells us that markets can be unpredictable, and downturns are inevitable. My advisor, like many others, believes that while market setbacks occur periodically, they are usually temporary, and the market tends to recover eventually. In preparation for such events, we're adjusting our strategy to capitalize on potential opportunities during downturns, while ensuring a significant portion of my investments are in safer options. It's worth noting some key facts: markets tend to experience declines every 18-24 months, and during bear markets, equities can drop by around 32%. My advisor anticipates a shorter-term downturn with declines of 15-25%, although external factors like inflation, interest rate hikes, or a recession could change the landscape unexpectedly. I'm not trying to offer financial advice here, just sharing insights from my advisor. We're focusing on daily rebalancing to maintain a diversified portfolio, ensuring we have enough allocated to safer investments. This isn't intended for public product sales; it's simply a reflection on our approach. However, my advisor emphasizes the importance of ongoing communication with his clients, particularly about their risk tolerance and options during market fluctuations. Every individual's situation is unique, and it's essential to have these discussions in a supportive and caring manner. In summary, have these conversations with your spouse and your financial advisor if you have one. If you don’t have someone who helps you with your finances, we can connect you with a financial services professional in your area. While some financial ads target those with significant assets, I appreciate that the services the Safe Money Places Agent Network provides cater to a broader range of people, not just those with substantial sums to invest. It's a reminder that financial planning is accessible to many, not just the wealthy. We are all familiar with these three great words and what they have meant to our country. It doesn’t matter what party you might align with, we all want our way of life preserved, protected and defended. That is the American way. Well, I would be remiss if I didn’t mention the obvious - there are a lot of geopolitical events happening that could alter or impact Americans portfolios and nest eggs. Again, placing party preferences to the sideline, many feel that inflation is a threat to their retirement income. I made mention to my wife yesterday about the price of gas. I put 20 gallons in the tank and paid about $1 more per gallon than last year. That is an additional cost of $20. Well, I am thankful that that will not up-end my financial life, but it is one of the things that can alter a retiree’s way of life. Let’s also look at taxation. If we spend what is proposed… tax rates will go up. And, even if the intentions are not to tax the majority of Americans, I say (from past experience) that they will have to be raised pretty much across the board to pay for all the “stuff” that is being proposed. So, what does all of this have to do with the title of this commentary? Let’s look… There is a lot of uncertainty in the world and that rattles everything that is financial. Taxes, inflation, geopolitical events, and unrest in the rest of the world might all play a part in a downturn in financial markets. So, now is the time for us to Preserve, Protect and Defend our nest eggs. With annuities, you will not lose a penny of principal or previous gains (speaking of fixed annuities). They can also guarantee a stream of income that you can’t outlive, regardless of how long you live or what the markets might do. We can offer dream completion through the tax-free death benefits of a life insurance policy. In the event of a chronic illness or long term care need, we can connect you with an advisor who has the products that will accelerate the death benefit to use for those health related expenses. In summary, let’s preserve the nest egg, protect the income streams and defend financial ways of life. Our roots, going back to 1975, show that we have weathered a few of these storms in the past.

We had all hoped that inflation would reduce with a reduction in gas prices. That didn’t happen and the equity markets are getting slammed. We can expect the Fed to raise rates. Asking prices on homes are coming down and mortgage rates are going up. Some companies are beginning layoffs and retail firms are stuck with inventory as discretionary income goes down. Of course, we have geopolitical events to deal with, and a declining national petroleum reserve. But this will pass…sometime - but most can’t wait. What to do? Read on… Current and pre-retirees are in a pinch and they are worried. But we have solutions. We have agents actively prepared to come to the rescue. Forget all the projections of the past few years, and focus on the guaranteed retirement income benefits of a Fixed Index Annuity (FIA) or a Multi Year Guaranty Annuity (MYGA). I am not suggesting that people dump all their equities because they will come back. I am hanging in there but I, like others, wish to add more “Safe Money Places.” Safe money is money you cannot afford to lose. Our wide selection of safe money products are perfect for today and tomorrow. If you are looking for guaranteed income and good return on short term products, look no further. Retirement Tips: Learn About The CD Alternative

My dad has been gone for about 9 years but my mom is still here at age 93. It is important for me to speak with my mom every day, but it’s not always possible. You see, she’s in an assisted living facility in the “memory care” section. My mom has dementia and she is often confused and lives in a former time in her life. To make matters worse, she is also blind. So, she needs people to help her in basically every element of daily living. She is in a great place that comes with a pretty steep price. And that makes all of us feel pretty comfortable because we know that she is safe. Her story is not that uncommon. Many people are dealing with situations like this. But most do not have the funds to stay in a place like this. Many would be in a Medicaid facility or a nursing home. Please read on as this just might help you. The cost for this place is about $7,500 per month. She has my dad’s social security along with an annuity that pays a very important role in her financial life. But, she is still shy about $4,000 per month and soon the pot will run dry. She did not have long term care insurance, nor a hybrid. This is the point of this writing. There are hybrid annuity and life policies with chronic illness benefit, death benefits, cash values and money back guarantees. But, what they don’t have (in some cases) is a requirement for a medical exam, blood tests, etc. These simplified issue policies are perfect for so many Americans. And, if the chronic illness benefits are not needed, the policy provides a tax free death benefit to the named beneficiaries. Bottom line, this is also a way to create a little bit of loss recovery for you and/or your family. Talk to an advisor in your area to explore options that could benefit you and your loved ones. For more information, request an appointment with a Safe Money Places Agent Member in your area.

What "Baby Boomer" doesn't remember that saying from Mr. Tarzan? I would be glued to the TV watching Tarzan defend Jane against all the bad guys. That is the way baby boomer men were brought up. Now, I am speaking for the older side of the baby boomer class. We know that the "baby boomer” years are between 1946 and 1966. But, in this writing, I am going to address the older segment of this group. "It is our responsibility to take care of our family." Ever heard this one from your mom or dad? “Ray, tonight you are the man of the house.” Or, as my father was passing away, "Ray, take care of your mother.” Let me get to the point. Okay, many men are having a rough time sleeping because they are worried about their spouse. Maybe there’s not enough life insurance, maybe the investments didn't work out as well as expected, or maybe they wished they had done more. And many think that they are too old to get more life insurance. Well, in most cases, they are wrong. If you’re feeling like Tarzan, we can get you a life policy (or policies). Where is the money going to come from? Maybe excess cash, maybe an annuity using the 10% free right of withdrawal, or maybe an RMD. This is a tremendous opportunity for "Tarzan" to swing happily through the trees again. It is a wonderful way to put a smile on Jane's face and improve your legacy. For more information, request an appointment with a Safe Money Places Agent Member in your area.

Time is measured for many of us from events in our lives that have meaning and strong remembrances. To each and every one of us, those special times may vary depending upon our individual experiences. However, there are those events that resound with the majority because of the history shaking significance that touches all of our lives at the same time. Such an event was September 11th, 2001. It seems almost impossible that event was nearly twenty years ago. Yet, we still measure many of our life experiences from that date forward. The recent pandemic underscores the truth of that last statement. By necessity, we have reshaped our lives and not necessarily always to our liking. For a majority of us, our homes became our offices. The home front was our boardroom and workshop for assembling the tools necessary to achieve our business and personal goals. Four different Presidents have led our country since 9/11– George W. Bush; Barack Obama; Donald Trump and Joe Biden. The significance of each of their accomplishments underscores the impact they have had on our collective lives. We have seen the Stock Market soar beyond our imagination, and bottom-out almost as quickly to our amazement. We have witnessed men and women’s achievements in space even reaching Mars, and then a lack of ability to sustain harmony here on earth. The closing of our favorite haunts and the impact of the dismissal of class study on our children is still to be assessed. Yes, there have been many “ups and downs” in the past twenty years. The question is then, “What do we have to look forward to?” When I was a young man, there was a motion picture series entitled “THE MARCH OF TIME” which centered on the days’ events that shaped the future of mankind. I looked forward to each one of those features on the movie screen because, with few exceptions, they pointed to a brighter more fulfilling lifetime ahead. Maybe I’m an incurable optimist, but I see and feel that we have much to learn from the past history of our country. We are a people who desire to create and to succeed. Thus, it is easy to realize that we have just begun to envision a brighter, more enlightened time ahead. The “long day’s nights” that we have experienced are coming to an end. We are starting to breathe the fresh air of personal freedoms again – planning vacations and family gatherings that will have new and many happy, emotional returns. We are opening the doors to our treasured past and are finding new avenues of expression that will pay personal dividends in a quest for happiness and security. Hopefully we have learned from past mistakes and will take our combined experiences to heart and heal wounds that have divided us. There is still much to be achieved and plenty of time if we will be patient and stay strong to accomplish all we desire. We are a people who are noteworthy in our strengths to remember our pasts, but with the foresight to not overlook our future. It is that reflection that helps us to remember that the “past is merely a prologue.” Enjoy today and keep your eyes wide open to what lies ahead. Let’s make the next twenty years the best remembered of them all! TIME MARCHES ON!

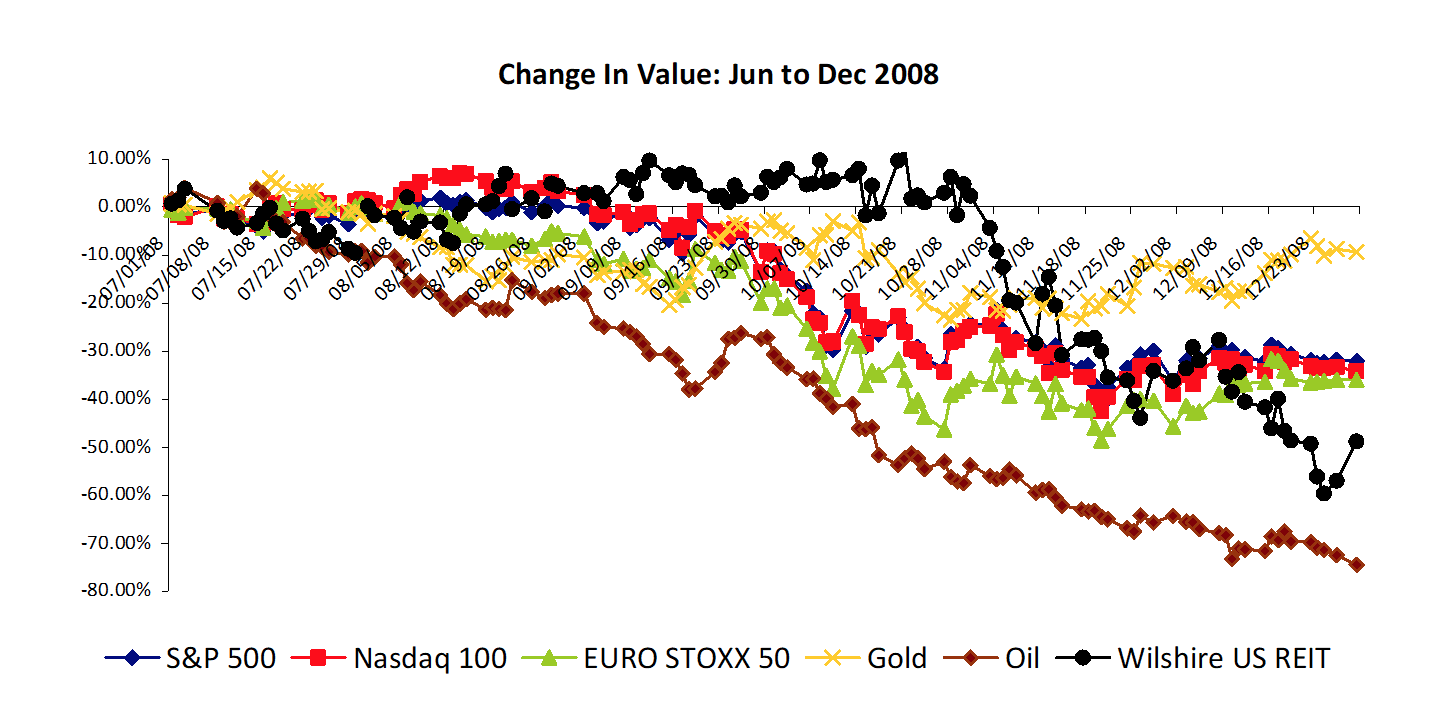

Chicken farmers say not to put all of your eggs in one basket. Investment analysts renamed this diversification. It amounts to the same thing – spreading out your assets in different baskets or investments is supposed to reduce the risk of loss. However, putting your eggs in different baskets doesn’t truly reduce the risk if one truck is carrying all the baskets and it gets in a wreck. The financial pros say you should blend together stocks of different industries, non-stock assets and bonds to reduce the risk of loss. However, there’s a problem. Especially in bad times, stock returns tend to move together, or correlate. Consider the Crash of 2008. Even if you diversified between stocks of large companies, small companies and foreign companies you lost big. Going into non-stock “alternative” investments didn’t help either. Whether you owned real estate, oil or gold, you had less in December 2008 than you had in June. That leaves bonds. Although bond yields went up at that start of the Crash – meaning the value of existing bonds went down – by the end of the year bond values had recovered and even had a small gain. However, bond yields are around half of what they were back in 2008. What that means is there is a lot less upside potential if interest rates fall and more downside risk of loss if rates go up.

Bank instruments such as money market accounts and certificates of deposit avoid market risk to principal, but the interest paid today is so low. Fixed annuities are another choice. Fixed rate annuities can lock in yields that are one to two percent higher than bank rates. Fixed index annuities provide the opportunity to earn even higher interest. Both types protect principal from market loss. No one knows when the next crash is coming or how long it will last. Even so, it doesn’t make sense to be Chicken Little and take all of your money out of stocks. However, it does make sense to set aside some egg money so that you know it will be protected from market loss. And when you’re looking for a protected basket, fixed annuities might well produce the biggest eggs. Copyright 2021. For educational purposes only. Does not provide investment, tax or legal advice. Information believed accurate, but is not warranted. Fixed annuities typically have penalties for early withdrawal, known as surrender penalties, which may cause a loss of principal if the annuity is cashed in prematurely. Past performance is not an indication of future results. No index sponsors, promotes, or makes any representation regarding any index product. Both investments and fixed annuities involve certain risks; a consumer should consult with their advisor. Fixed annuities are not bank instruments and are not insured by FDIC. Okay Baby Boomers, I am in your camp and I am sorry to announce that there are more yesterdays than tomorrows in our lives. Where did all the time go? Even though life is uncertain and every day is a gift, we felt okay saying… ”I will get to that tomorrow.” But, regarding our financial lives, we need to get on it today. It is time for all of us to take a financial inventory and review our game plan. It’s time to sit down with your spouse, family or any people that could be affected by your passing. Look at life insurance policies, wills, trusts, investment accounts, annuities and bank accounts. It’s also a great time to review your final instructions. It’s never too late to fine tune your income accounts and plans. Do you have the appropriate amount of income to stay in the world that you have planned and become accustomed to? What about final expense money and policies? Is it time to consider additional life insurance? Do you know that life insurance is easier to buy, and you probably won’t need a medical exam? Do you need to take a look at your “Safe Money Portfolio?” What about sitting down with your financial professional to do a review? Don’t you have a visit with your physician every year? Visit the dentist? What about keeping your car serviced? It’s time to take action. If you don’t have a financial professional, let us know and we will connect you with a licensed insurance agent that is a member of The Safe Money Places Agent Network. Remember, don’t put off till tomorrow what you can do today. Tomorrow might not come. Stay safe and do it.

While flying the other day, I looked up at the fasten seatbelt sign as the pilot said to stay in our seats as we may be hitting some turbulent air. So, of course I complied. But it got me thinking about a message we might want to be giving our clients and prospects... “Fasten seat belts while invested, as we may be hitting some market turbulence and volatility over the next several months.” But, instead of advising them that an oxygen mask will drop or that you can use the cushion as a flotation device, we can tell them the following, “During this turbulence, all monies in a fixed index annuity will be protected from loss of principal and previous gains.” Now, can I continue to talk about airline experiences? A few months ago, we were flying back to Hilton Head from Indianapolis and ran into some rough weather. The pilot was a pro, but we circled quite a bit. He then advised the passengers that we were going to make a stop in Savannah to get some fuel as he was afraid that we might run out of gas. So, we landed, gassed up and were on our way without a hiccup. Well, let's remind the client that they won't run out of gas with a fixed index annuity. The gas we’re are talking about is the lifetime income. Doesn't matter how long you live or the weather situation, your income is guaranteed until the day you die. So, for the passengers with the fixed index annuity, sit back, enjoy the flight as we will be landing shortly. Like to know more about fixed indexed annuities? Ask your licensed member of the Same Money Places Agent Network

There are so many items in our lives that require regular maintenance. Let’s think about this for a second. Don’t we take care of our cars? Yes, change the oil, make sure tires are rotated and make sure that everything is functioning well before a trip? What about your heating and cooling systems? Of course we stay on top of this. We don’t want to lose heat when the weather turns cold nor lose the A/C when the sun starts to bake us in the summer. We go to the dentist on a regular basis, get regular check ups from our physicians and also make sure that our eyes are working well. I could go on and on. But, are you performing regular maintenance on your retirement income accounts? Sadly, I find that many Americans don’t. And, that can cause some real problems in American’s lifestyles. Let’s examine… If you are retired, or soon to be retired, you have hopefully divided your income needs into a couple of categories. The first being the essential income that you will need to stay in the desired income life that you have planned on. You take those expenses and subtract social security income, pension income if you are lucky enough to have one, and other guaranteed forms of income. That is when you find the shortfall. Then, there is the discretionary income that you desire. You know, vacations, trips with the kids or grandkids, educational assistance for your loved ones, etc. And, many Americans find this to be a little nerve racking. Maybe I can suggest something to make your retirement a little more safe and serene. I suggest an annuity that can provide a guaranteed flow of income for as long as you live might just allow you to spend more, relieve stress and protect this nest egg from losses. Isn’t it great to know that there is an additional check sent to you each month. It is a great way to “plug the gap” and provide the essential income that you need. Now, there are various forms of annuities to choose from. And, I feel pretty confident that you will find one to help you achieve the retirement dreams that you have. Contact a licensed insurance agent that is a member of “The Safe Money Places Agent Network” and have that maintenance review that I am talking about. Great for peace of mind. What do you have to lose? I feel pretty confident that you will start gaining better sleep at night. I love annuities and know that you will to. Stay Safe.

You have a legacy plan. If you say, “I haven’t set up a legacy plan,” I say, yes you have. Without proper planning, you allow the government, nursing home facilities or others to do it for you. Of course, you need a good will and possibly thoughtful trusts to get you headed in the right direction. You also need health directives to make sure your wishes are followed through. And, you need an executor to make sure things are handled properly. As an insurance professional, I can help take care of some basic planning that can help you avoid the pitfalls of not having a plan in place. I can take care of legacy planning, income needs and planning for long-term care needs. Please allow me to explain… Today I am going to focus on life insurance with accelerated benefits for long term care needs, and products that have accelerated benefits. In short, accelerated benefits on life insurance products mean that the death benefit would be paid out to you while living if you can’t perform two of the six activities of daily living. Let’s look at a real-life scenario. You may have some dollars set aside that won’t be needed for retirement income. You purchase a life insurance policy (this could be a single premium life policy or a periodic premium plan) with the accelerated benefits as described in the paragraph above. Let’s assume that a health issue develops, and you can’t perform two of the six activities of daily living. Let’s say that you opted for a single premium life policy with $100,000 of premium. That premium would generate for a 65-year-old female anywhere between $180,000 and $300,000 of tax-free death benefit (the more underwriting… the greater the death benefit). So, let’s assume this policy has a $200,000 death benefit. If a health issue occurs and you cannot perform two of the six activities of daily living – then, the entire $200,000 death benefit is paid out to you in tax-free payments. These payments are generally tax-free because they are an acceleration of the death benefit. These payments are paid directly to you, and you are able to use them to cover your health care costs. But what happens if I don’t need those accelerated benefits and I pass away? The proceeds are paid tax-free to a named beneficiary. What happens if you have an emergency and need the money? These products accumulate cash value and you have access to the cash value when and if you need it. Some life insurance policies offer a return of premium feature. This means if you decide to quit the policy, the insurance company will give you the premium you paid back. Your financial professional can provide you with information on this type of product. What do you have to lose? This is a tax friendly approach to an important part of your retirement plan. Let me know if you would like more information about this type of legacy planning.

In more than eight decades of my life, I have experienced many down turns as well as positives enough to fill many essays and dreams. If there is anything I have learned over time, nothing lasts forever. In a flick of an eye, situations – good as well as bad – will change, and normalcy will reclaim our lives, and we will survive and be better for it. Trying to compare our recent year of the covid 19 virus with past experiences can be difficult. The year 2020 has few comparisons unless you go back to 1917 and the Spanish Virus. Obviously, there are very few people who remember those dreadful days. In the over one hundred years since then, there have been many times when we have faced difficult disease outbreaks, and even wars, yet we have survived and found means to overcome adversity. The American Spirit prevails in the darkest of days. Our faith and country go hand in hand meeting the challenges and brushing aside negatives that try to lead astray. The only comparison that I feel is realistic in my family goes back to the early and darkest days of early World War II. Families were split apart with fathers, brothers and other relatives being shipped far away; the print mediums and radio broadcasts highlighted negative news from various fronts, rationing of essentials such as gasoline and rubber prevented people traveling to visit family and friends. Mom found her pantry shelves void of the sugar and spices - many of the essentials necessary to bake the many holiday surprises we were fond of enjoying. I remember how my sister and I felt as young children. Would there ever be another other Christmas like the ones we remembered from our limited past? We were separated from family and friends, even though our parents were tying hard to convince us that Santa Claus would still find us even hundreds of miles from our normal home. It compared to this year in many ways, and yet, we felt blessed that we were still free and able to communicate our lives and loves to those who meant so much to us. Today, we are more fortunate to have many means of communicating instantly to those who are separated from us. With modern conveniences such as computers and cell phones, even though we may be apart, we come together instantly from any part of the country or world. In many cases photos are transmitted just as quickly as voice messages. We are being held together even though we are apart. Yes, today is challenging, yet we know and believe we will overcome all that we are facing. It is in our minds and hearts to be strong and stay the course to a brighter more fulfilling future. Another day…we’re moving on… To address the challenges…others have come and gone. We’ve adjusted to wearing a mask, Though it is made more difficult to complete a task. A burger and fries from a local drive thru, Have replaced group gatherings we once knew. Family and friends stay a distance apart, When a nice hug and kiss would heal a heart. Not having togetherness can be lonely, But let’s not be caught saying…”if only.” Let’s reach out to those we know…many or few, With a call or note or even an e-mail will do. Move on in positive ways, To make these the best of our days. A very Merry Christmas and a much Happier New Year 2021

Happy Holidays. If you are like many Americans, you’re wondering when to take retirement income… and how much. Well, for those of you old enough to remember layaway, this might just work for you. The “layaway” concept is also referred to as “laddering” by many. In other words, let some of the money continue to grow for a while, tap another part of the nest egg for a period of time and then release the balance in a retirement income flow. Let me give you a couple of examples. Now, remember, each situation is different and you will want to confer with your financial professional. Here we go… Let’s say we have a male ready to retire at age 66. He can take Social Security now, as he needs the money, but wants to maximize the value of his Social Security retirement income. Let’s also say that his Social Security retirement income is $2500 per month at age 66. He could leave that Social Security alone until he reaches age 70. That $2500 is guaranteed to grow at 8% per year with no current taxation. Very tough to beat today. But, remember, he needs $2500 per month now. What to do? He could get a 4 or 5 year single premium immediate annuity for the period until he is 70 years old. Then, when that money is finished, he then takes Social Security which is much more than the $2500 at age 66. But, he has other moneys and will need more at age 75. So, he could purchase a fixed index annuity with a lifetime income rider to get the additional income he desires and take retirement income off of this account at age 75. Sound confusing? Let me help. With this concept, your financial professional will only need to ask you two questions. “How much do you need?” And, “when do you need it?” He can give you the exact amount of money you need to put in “layaway” to achieve your retirement income needs. So, let’s empty that worry bucket. Holidays are approaching, and this is one worry we can eliminate.

With bank savings accounts earning pennies in interest, and even long-term certificate of deposit rates averaging less than one percent, it can cause a squeeze in the household finances. One result is some people go on yield safaris, looking for bigger interest game. While there is nothing wrong with trying for higher returns, the concern is that the potential for loss is sometimes overlooked. A decade and a half ago auction rate securities and mortgage bond tranches were sold as low risk, liquid alternatives during a period when bank rates were falling. However, auction rate securities largely became illiquid and many of the “AAA” bonds were reclassified as junk or in default in 2008. This time around some savers were buying packages of small business debt – but the impact of SARS-CoV-2 is causing small businesses to fail. Others are buying dividend paying stocks – often a sound move, but even companies like Ford creased their dividend in 2020. The more adventurous try covered call option writing, where you collect a fee for agreeing to sell a stock you own at a given price. It works well when the stock price is steady; however, all the option fees put together cannot overcome a big drop – like Exxon Mobil share price falling roughly in half in 2020. If you’re a saver looking for a place that pays higher interest than the bank, but still protects your principal and the interest you’ve earned from market loss, the alternative is pretty much coming down to fixed annuities. Although a fixed annuity is not FDIC insured, fixed annuity carriers have an excellent record of protection in both good and bad financial times. There are two main types. A fixed rate annuity pays a locked-in interest rate for a specified number of years – anywhere from one up to ten. A fixed index annuity pays interest based on the performance of an independent index, usually linked to the stock market. Which is better? It depends. With a fixed rate annuity you know what you’re getting. With a fixed index annuity if the index goes down you won’t earn any interest for that year (but you won’t lose what you have). However, the fixed index annuity often offers the potential for considerably more interest, so if the good years offset the bad they could pay much more interest. It ultimately comes down to whether you’re okay with seeing a zero in a given year. Fixed annuities have penalties for early withdrawal called surrender penalties. For fixed rate annuities with multiple year interest guarantees the penalty period usually matches the guarantee period. Fixed index annuity penalty periods are usually for five to ten years. The early penalties are much higher than those imposed on certificates of deposit – so you shouldn’t buy the annuity if you think you’ll need to cash it in early – but you need to look at the entire picture. If your choice is between a CD paying 0.75% and a fixed rate annuity paying 2.5% that has a 6% penalty, you are money ahead with the annuity after four years, even after cashing it in. This is a very tough time for savers, and it doesn’t look like yields will be going up anytime soon. Even so, this isn’t the time to quit the bank and start hunting exotic yield beasts that could come back to bite you. It is a good time to consider moving some of that money to the protected sanctuary of fixed annuities. For educational purposes only. Does not provide investment, tax or legal advice. Information believed accurate, but is not warranted. Not a solicitation to buy or sell any security. Past performance is not an indication of future results. Both investments and fixed annuities involve certain risks; a consumer should consult with their advisor. Fixed annuities are not bank instruments and are not insured by FDIC. It goes without saying that most of us will be glad for 2020 to end, as it has been one of the most exhausting years in modern history. This past year is undeniably one for the history books on many fronts, including: human pandemics, the stock market, the economy, social impacts and politics. There is no doubt students and historians will be studying and analyzing 2020 for decades to come. Amazingly, despite the trials and tribulations 2020 has delivered, as of this writing, the markets are in positive territory for the year, despite being one of the most volatile markets in history. Below we review the events that caused this volatility. 2020 events that are statistically unlikely to reoccur in our lifetime…

S&P 500 (year to date) Planning: Year-End Financial Planning Deadlines As 2020 comes to an end, there may be a few items that need to be completed before the clock strikes midnight on December 31st.

Dream boldly. Plan wisely.

It's time to implement strategies to help reduce your 2020 federal income tax bill and position yourself for future tax savings. Here are some ideas to consider before year end. Gaming the Standard Deduction The Tax Cuts and Jobs Act (TCJA) almost doubled the standard deduction amounts. For 2020, the standard deduction allowances are:

The easiest itemizable expense to prepay is included in home mortgage payments due on January 1, 2021. Accelerating that payment into 2020 will give you 13 months' worth of itemized home mortgage interest deductions for this year. Beware: The TCJA limits these deductions, so consult with your tax advisor before prepaying your mortgage. Other items to consider prepaying are state and local income and property taxes that are due early next year. Prepaying those bills before year end can decrease your 2020 federal income tax bill, because your total itemized deductions will be that much higher. However, the TCJA decreased the maximum amount you can deduct for state and local taxes to $10,000 ($5,000 for married couples who file separate returns). Important: Prepaying state and local taxes can be a bad idea if you'll owe the alternative minimum tax (AMT) this year. That's because write-offs for state and local taxes are completely disallowed under the AMT rules. Therefore, prepaying those expenses may do little or no good for people who are subject to the AMT. Fortunately, the TCJA eased the AMT rules, so most people are no longer at risk. To maximize your itemized deductions for 2020, you also could make bigger charitable donations this year and then make smaller donations next year to compensate. Or you might consider accelerating elective medical procedures, dental work and expenditures for vision care. If you itemize for 2020, you can deduct medical expenses to the extent they exceed 7.5% of your adjusted gross income (AGI). Next year, the deduction threshold is scheduled to rise to 10% of AGI. Managing Gains and Losses in Taxable Investment Accounts If you hold investments in taxable brokerage firm accounts, consider the tax advantage of selling appreciated securities that have been held for over 12 months. The federal income tax rate on long-term capital gains can be as high as 20%, plus the 3.8% net investment income tax (NIIT) can also apply at higher income levels. (See "Current Individual Federal Income Tax Rate Scene" at right.) To the extent you have capital losses from earlier this year or capital loss carryovers from prior years, selling appreciated investments this year won't result in a tax hit. In particular, sheltering net short-term capital gains with capital losses is a tax-smart move because net short-terms gains would otherwise be taxed at higher ordinary income rate of up to 37%. Conversely, if you have some loser investments — that are currently worth less than what you paid for them — you might want to unload them. Taking the resulting capital losses this year would allow you to shelter capital gains, including high-taxed short-term gains, from other sales this year. If selling some loser investments would cause your 2020 capital losses to exceed your 2020 capital gains, the result would be a net capital loss for the year. It can be used to shelter up to $3,000 of 2020 income from salaries, bonuses, self-employment income, interest income and royalties ($1,500 for married couples who file separate returns). Any excess net capital loss can be carried forward indefinitely. A capital loss carryover can be used to shelter short- and long-term gains recognized next year and beyond. This can give you extra investing flexibility in those years, because you won't have to hold appreciated securities for over a year to get a lower tax rate. You'll pay 0% to the extent you can shelter gains with your loss carryover. Depending on future tax rate changes, these loss carryovers can be quite valuable. Donating to Charities You can also make gifts to your favorite charities in conjunction with an overall revamping of your investments in taxable brokerage firm accounts. But there are two principles to keep in mind. First, don't give away investments that are currently worth less than what you paid for them. Instead, sell the shares and book the resulting tax-saving capital loss. Then you can give the cash sales proceeds to favored charities — plus, if you itemize, you can claim the resulting tax-saving charitable write-offs. The second principle applies to investments in appreciated securities. These winning investments should be donated directly to a preferred charity. Why? Because, if you itemize, donations of publicly traded shares that you've owned for over a year result in charitable deductions equal to the full current market value of the shares at the time of the gift. Plus, when you donate appreciated shares, you escape any capital gains taxes on those shares. Meanwhile, the tax-exempt charitable organization can sell the donated shares without owing federal taxes. Gifting to Family Members The principles for tax-smart gifts to charities also apply to gifts to relatives. That is, you should sell loser investments and collect the resulting tax-saving capital losses. Then give the cash sales proceeds to loved ones. Likewise, you should give appreciated shares directly to relatives. In many cases, they'll pay a lower tax rate than you would if you sold the same shares. Making Charitable Donations From Your IRA IRA owners and beneficiaries who have reached age 70½ are permitted to make cash donations totaling up to $100,000 to IRS-approved public charities directly out of their IRAs. You don't owe income tax on these qualified charitable distributions (QCDs), but you also don't receive an itemized charitable contribution deduction. The upside is that the tax-free treatment of QCDs equates to an immediate 100% federal income tax deduction without having to worry about restrictions that can delay itemized charitable write-offs. Contact your tax advisor if you want to hear about the benefits of QCDs. If you're interested in taking advantage of this strategy for 2020, you'll need to arrange with your IRA trustee for money to be paid out to one or more qualifying charities before year end. Prepaying College Tuition Bills The TCJA retains two valuable tax credits for higher education costs. 1. American Opportunity credit. This credit equals 100% of the first $2,000 of qualified postsecondary education expenses, plus 25% of the next $2,000 (assuming the phaseout rule explained later doesn't affect you). So, the maximum annual credit is $2,500. For 2020, the American Opportunity credit is phased out (reduced or eliminated) if your modified adjusted gross income (MAGI) is between:

For 2020, the Lifetime Learning credit is phased out if your MAGI is between:

Specifically, you can claim a 2020 credit based on prepaying tuition for academic periods that begin in January through March of next year. If your MAGI is too high to be eligible for the Lifetime Learning credit, you might still qualify to deduct up to $2,000 or $4,000 of college tuition costs for 2020. If so, consider prepaying tuition bills that aren't due until early 2021 if that would result in a bigger deduction this year. As with the credits, your 2020 tuition and fees deduction can be based on prepaying tuition for academic periods that begin in the first three months of 2021. Important: The higher education tuition and fees deduction is scheduled to expire after 2020, unless Congress passes legislation to extend it. Deferring Income Into Next Year — or Not If you expect to be in the same or lower tax bracket next year, you might want to defer some taxable income from 2020 into 2021. For example, if you operate a small business that uses the cash method of accounting, you can postpone taxable income by waiting until late in the year to send out some invoices. That way, you won't receive payment for them until early 2021. Small business owners can also defer taxable income by accelerating some deductible business expenditures into this year. Both moves will postpone taxable income from this year until next year when it might be taxed at lower rates. Deferring income can also be helpful if you're affected by unfavorable phase-out rules that reduce or eliminate various tax breaks, such as the child tax credit and the higher-education tax credits. On the other hand, if you expect to be in a higher tax bracket in 2021, consider accelerating income into this year (if possible) and postponing deductible expenditures until 2021. Converting an IRA to a Roth IRA The best scenario for converting a traditional IRA into a Roth account is when you expect to be in the same or higher tax bracket during retirement. Currently, tax rates are low by historical standards, but there's been discussion of increasing taxes in the future to fund COVID-19 financial relief measures and various spending priorities. So, now might be a good time to consider a conversion. Beware: There's a current tax cost for converting. A conversion is treated as a taxable liquidation of your traditional IRA followed by a nondeductible contribution to the new Roth account. If you wait to convert your account until 2021 or later, the tax cost could be higher, depending on future tax rates. After the conversion, all the income and gains that accumulate in the Roth account, and all qualified withdrawals, will be federal-income-tax-free. In general, qualified withdrawals are those taken after:

Meet With a Tax Pro The future of federal income taxes for individuals is uncertain. But at least you know the rules that will apply for 2020. Contact your tax advisor to discuss ways to best position yourself for this year and beyond.

Many people only think of an annuity as something that pays an income for as long as they live. This is one benefit all annuities – and only annuities – offer. It is also the reason why people buy immediate annuities (also called income annuities). However, the lion’s share of annuities are purchased as saving places and never turned into immediate annuities (the conversion is called annuitization). One of the reason annuities are used as saving places is that taxes on any interest earned may be deferred as long as the interest remains inside the annuity.

There are two main branches on the annuity tree: Variable annuities are registered as securities and offer various investments. Since they are securities they are subject to stock market risk and can lose money. When you hear that annuities have fees, they are usually talking about variable annuities. Variable annuities can be annuitized and turned into a lifetime income stream, but the income will fluctuate depending on how the underlying investments perform. Fixed annuities do not subject principal or interest earned to market risk – in others words, you can never lose what you’ve made because the stock market went down or some bond issuer went out of business. Fixed annuities can also be annuitized, but the income will remain stable and not go down. Fixed Annuities as Saving Places Annuities used as saving places are called deferred annuities, because, as mentioned, the annuity owner has control over when to take the interest out of the annuity and pay income taxes on it. All fixed deferred annuities guarantee a minimum return. The three types credit interest in different ways: Fixed Rate Annuities declare a new interest rate each year. It will fluctuate, but will never be less than the minimum interest rate stated in the annuity. Multi-Year Guaranteed Annuities (MYGAs) lock in a rate for the term selected of two to ten years. Fixed Index Annuities base the amount of interest earned on the performance of an external index. Although the degree to which the annuity participates in any gains is locked in, the actual interest earned depends on well the index performs. Since this is a fixed annuity it does not lose any value if the index goes down, instead, zero new interest is earned for the period. Fixed Annuities for Income Immediate annuities pay an income for a specified period of years or for life. The biggest concern when getting an immediate annuity with a life income is dying too soon, with the result that the annuity company keeps most of the money. This can be offset by setting up the annuity to pay for the greater of life or a specified period of years (life with period certain). You can also choose a cash refund option that means payments will continue until all of the principal has been returned if early death occurs. Withdrawals are another way to get income. The deferred annuity remains intact, but the annuityowner takes out the interest earned each year. Indeed, most deferred annuities allow the withdrawal of up to 10% of the value each year without penalties. Guaranteed Lifetime Withdrawals Benefits (GLWBs) are withdrawals from the deferred annuity, but they are guaranteed to last a lifetime even if the annuity account goes to zero. The income is stable, but unlike an immediate annuity, here the annuityowner retains control over the remaining account balance. GLWBs are usually an optional benefit for which a fee is charged. Annuity Vocabulary Annuities have similarities with other savings choices (and one difference): IRS “Under Age 59½” Premature Distribution Penalty is in addition to the normal income taxes owing, and can be avoided if certain conditions are met. In the case of annuities not held in qualified plans, the penalty only affects withdrawn interest earned over and above the original principal. Penalties for Early Withdrawal (surrender charges) are made if the annuity is cashed in prior to the end of the term initially agreed to. Surrender periods vary in length from one to twelve years. For the vast majority of policies, penalties do not apply if the policy is cashed in due to death of the owner. The annuity may be continued after the penalty period and no penalties are charged. Maturity Date is the longest one can keep annuity interest deferred before it must be taken out. Maturity dates usually occur when the annuitant celebrates their 80th to 90th birthday, but some new policies may be kept until age 100 (the annuitant is the person upon which the annuitization life income is based – usually the owner). Although many financial writers get this confused, the maturity date is not how long the insurance company makes you keep your annuity with them, but how long the insurer will let you keep your money with them. For educational purposes only. It does not provide investment, tax or legal advice. Information believed accurate, but is not warranted. Past performance is not an indication of future results. Both investments and fixed annuities involve certain risks; a consumer should consult with their advisor. Fixed annuities are not bank instruments and are not insured by FDIC. This November, you will be voting “red or blue” in the Presidential election. The most of important thing, of course, is that you vote. I don’t want to sound like a broken record and say that these are not normal times. But, what if they are for a while. Many years ago, I attended a conference where they spoke of the “circle of concern and the circle of influence.” The circle of concern is much larger. And, they are items that we usually don’t have any control or an ability to influence, these items. Sure, they keep us up at night but beyond our control. Examples could be a hurricane, tornado, COVID-19 etc. On the other hand, the “circle of influence” is comprised of items that we can influence and change... or, at least protect ourselves from. Let me explain. My title of this article is “Red or Blue… but not Black AND blue.” Yes, you can affect change through your vote. But, how do you protect your nest eggs from getting “Black and Blue?” I am referring to some very volatile times in the equity markets. Please allow me to state that I am not giving investment advice. As you know from my previous writings, that I am and always have been a big fan of the equity markets. So, I am speaking to Baby Boomers and above. Do you have the appropriate amount of money at risk? Can you afford another potential downturn in the market? Do you have the “stomach” for a 10%, 15%, 20% or more drop in the market? Now, I can’t control the market… it is in my circle of concern. But, I can influence the outcome by making sure I have the proper amount of my nest egg in Safe Money Places. So, in closing, make sure you vote… red or blue. But, don’t let your nest egg get “Black AND Blue.” You can influence that. If you would like to discuss options with a licensed agent in your state, give us a call and we will set up the appointment. Or, contact a member of the Safe Money Places Agent Network. Stay safe.

I don’t think that I need to say that these are not ordinary times. This pandemic is (I hope) a once in a lifetime occurrence. I, like you, have witnessed many events that we could not avoid. One only has to remember 9/11, the dot com crash in 2000, and the financial meltdown in 2008/2009. But, this COVID-19 experience may top the charts. While I am confident that we will get through this pandemic, there will still be carnage. Today, I am speaking about retirement income nest eggs for current, or soon to be, retirees. I would also like to remind you that I am not giving investment advice . I do believe in the equity markets, I do understand that long term markets have always come back. But, for many of us, there might not be time to build those accounts to the numbers we had imagined. That is why I am speaking of a retirement income vaccine. Okay, let’s get the genie out of the bottle. I am speaking about annuities that can provide a steady stream of guaranteed retirement income. I am not here to argue about whether equities or annuities are best. I am also not here to suggest that you empty your “equity bucket” and place all your money in an annuity. But, I am suggesting that you empty some of your “worry buckets.” If you are like me, you look forward to a steady stream of retirement income that is guaranteed and one that you can’t outlive. So, I have some suggestions. First, identify what is keeping you up at night. Next, look at a timeline and identify the date that you will need the retirement income. Separate essential from discretionary income needs. Then, ask yourself if you have the appropriate amount of money at risk. Then, make a decision. Is it time to place some of your nest egg in a product that will guarantee principal and all previous gains? Yes, in some products there are penalties for early withdrawals, but as long as you play by the rules… all will be safe. Some of these products will allow you to take income immediately, and some you can defer payments. Yes, these are annuities. I suggest that it could just be the vaccine that your retirement income account needs. Stay safe, do your homework… but do investigate an annuity. No, I am not giving investment advice. I’m just giving you an additional tool to help you sleep at night.

Family reunions and gatherings are a great way to stay in touch with the people we love. Unfortunately, the current state of COVID-19 and the lurking possibility of a second or third wave of outbreak may make these activities difficult to plan. However, remote apps like video chat and EVites make it possible for families to still connect for large gatherings from a distance. Here are some of the best apps for remote family reunions that can ensure you and your family are still able to enjoy time together.

Best Video Chat Apps for Family Reunions We’re probably all familiar with easy video chat apps like Facetime, but there are others that allow for many users to join at once. Connecting over these can be done from a desktop or laptop computer, as well as mobile devices like phones and tablets. Most of these are free and just need one person to host the event from their device and invites to be sent to others.

Planning reunions and get togethers can be a logistical difficulty, particularly when you a large guest-list. This is even more true from a distance, as more folks may be able to join without the added difficulty of traveling far distances. For that reason, EVites and digital invitation apps are a big help. In addition to being a convenient way to keep track of who’s joining your event, these apps also feature beautiful design options that can give your invitation that personalized and colorful feel you crave.

Best Polling Apps for Family Reunions Everyone seems to have an opinion when it comes to event planning. Whether it’s about the group activities, timing questions, or decisions about which video chat app to use, a polling application can allow a user to ask questions and get a precise count as to which options work best. You might use these to ask questions like, “What day works best for our virtual family reunion,” or, “Which games do we want to play?”

Did you know you can sell all or a portion of a life insurance policy, even term insurance? Selling an unwanted life insurance policy is no different than selling your car, home or any other valuable asset that will create immediate cash. Contact us today to learn more. Leo LaGrotte Life Settlement Advisors [email protected] 1-888-849-0887 |